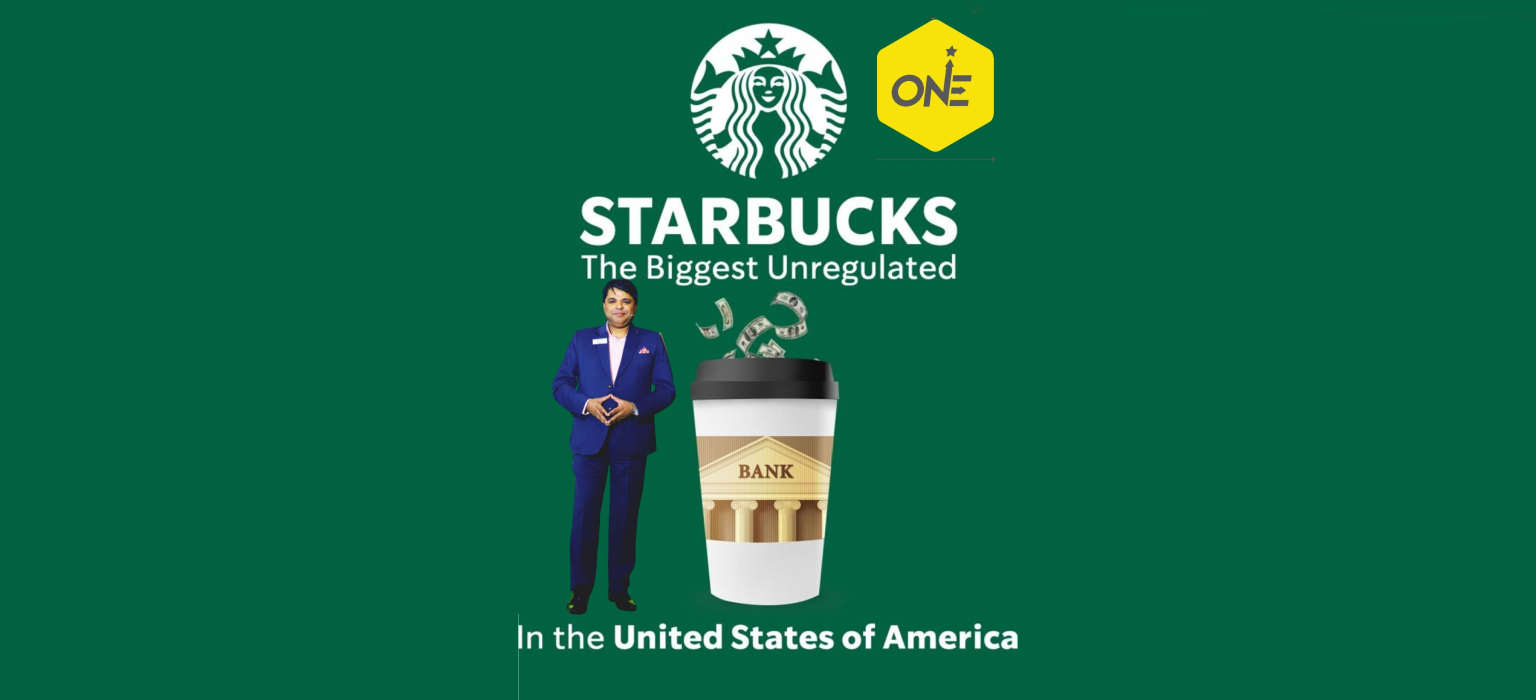

𝗬𝗲𝘀 𝘆𝗼𝘂 𝗵𝗮𝘃𝗲 𝗿𝗲𝗮𝗱 𝗶𝘁 𝗿𝗶𝗴𝗵𝘁, #𝗦𝘁𝗮𝗿𝗯𝘂𝗰𝗸𝘀 𝘄𝗵𝗶𝗰𝗵 𝗶𝘀 𝘄𝗼𝗿𝗹𝗱’𝘀 𝗺𝗼𝘀𝘁 𝘁𝗿𝘂𝘀𝘁𝗲𝗱 𝗮𝗻𝗱 𝗹𝗮𝗿𝗴𝗲𝘀𝘁 𝗰𝗼𝗳𝗳𝗲𝗲 𝗯𝗿𝗮𝗻𝗱𝘀 𝗶𝗻 𝘁𝗵𝗲 𝘄𝗼𝗿𝗹𝗱 𝗶𝘀 𝗮𝗹𝘀𝗼 𝘁𝗵𝗲 𝗯𝗶𝗴𝗴𝗲𝘀𝘁 #𝗯𝗮𝗻𝗸 𝗶𝗻 𝗨𝗦𝗔, 𝗮𝗻 ‘𝗨𝗡𝗥𝗘𝗚𝗨𝗟𝗔𝗧𝗘𝗗’ 𝗯𝗮𝗻𝗸 𝘄𝗵𝗶𝗰𝗵 𝗵𝗼𝗹𝗱𝘀 𝗺𝗼𝗿𝗲 #𝗰𝗮𝘀𝗵 𝗿𝗲𝘀𝗲𝗿𝘃𝗲𝘀 𝘁𝗵𝗮𝗻 𝟴𝟱% 𝗼𝗳 𝗮𝗹𝗹 𝗨.𝗦. 𝗯𝗮𝗻𝗸 𝗿𝗲𝘀𝗲𝗿𝘃𝗲𝘀 𝗮𝗻𝗱 𝘁𝗵𝗮𝘁 𝘁𝗼𝗼 𝗮𝘁 𝘇𝗲𝗿𝗼 𝗽𝗲𝗿𝗰𝗲𝗻𝘁 𝗶𝗻𝘁𝗲𝗿𝗲𝘀𝘁.

Interested to know more, how Starbucks popularized the use of pre-paid cards by integrating with its customer loyalty program and became the biggest UNREGULATED BANK in USA.

𝙇𝙚𝙩’𝙨 𝙙𝙚𝙘𝙤𝙙𝙚 𝙩𝙝𝙞𝙨 𝙛𝙤𝙧 𝙮𝙤𝙪 𝙖𝙨 𝙮𝙤𝙪 𝙧𝙚𝙖𝙙 𝙩𝙝𝙞𝙨 𝙥𝙤𝙨𝙩.

With the exponential growth in digital transactions Starbucks customers have also been increasingly opting to pay with their Starbucks pre-paid account instead of cash or credit cards over the years as they find it has the best loyalty program.

The customers receive additional discounts or rewards after making payments through Starbucks accounts. Many retail and restaurant chains across the Globe have followed the Starbucks rewards program as a model for their customer loyalty programs as well.

Starbucks launched its first reloadable cards on November 14, 2001 and since then Starbucks’ loyalty programs are well-loved by its large customer base.

Do you know why?

Because the Starbucks loyalty program offers ease of use and anyone can be a part of the scheme smoothly. The structure of these loyalty programs is quite simple and extremely appealing that many customers get attracted to them, making them No. 1.

Starbucks now has 24 million members with $1.6 #billion cash reserves in deposits which is more than 85% of all U.S. banks cash reserves put together in it’s unregulated bank. Interestingly, it does not even pay interest on the balances held on its app or with gift cards. Starbucks enjoys interest-free liabilities from its loyal customers. Moreover, it’s also worth your attention that most of the loyalty programs’ money (gift cards) is never fully redeemed by the customers.

There are millions of Starbucks gift cards given and received every year, which can attract new customers and make existing customers’ lives easier. Card themes range from birthdays, Diwali, Christmas to Mother’s Day and Teachers’ appreciation. Amazon, Walmart, and Starbucks’ websites all sell them, and they are a popular gift for people you don’t know very well.

Research indicates recipients rarely use the full amount , nearly 40% of 18-29-year-olds lose their gift cards before they can spend them, and around 25% of 30-64-year-olds do the same, the card issuer gets interest-free money.

As per the data available Starbucks gift cards (value $164.5 million) never got redeemed in 2020. In essence Starbucks received that money as a gift.

Now this is the power of well-structured loyalty programs like Starbucks.